Cryptocurrencies Stablecoins Digital Currencies How Do They Work

Cryptocurrencies are known for their volatility compared to fiat currencies. They allow users to exchange stable currencies cheaply and quickly anywhere in the world.

Stablecoins Everything You Need To Know About The Holy Grail Of Cryptocurrency Coinzodiac Cryptocurrency Investing In Cryptocurrency Blockchain Cryptocurrency

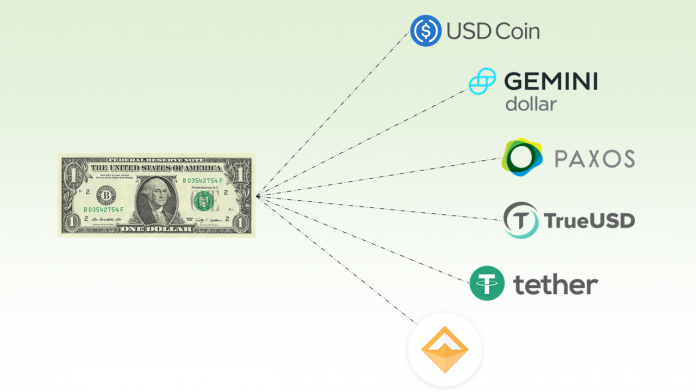

Numerous stablecoins have come to fruition in the cryptocurrency space.

Cryptocurrencies stablecoins digital currencies how do they work. In both cases a complex system that issues currency and records transactions and balances works. Heres how stablecoins work. They also are used for other types of financial exchanges such as lending and borrowing or sending payments overseas for example to family members in a much faster more seamless way than through.

How do they work. Price stability scalability. So investors buy stablecoins not to make a profit but instead as a place to store money within the cryptocurrency infrastructure and to use when buying and selling other crypto assets.

Cryptocurrency is a piece of digital code that is traded as an asset. Additionally they can offer mobility and. They promise lower.

What are they and how do they work. These are assets that are pegged to fiat currencies in particular the US dollarSuch coins help users to insure against cryptocurrency volatility and play the role of a reliable medium of exchangeStablecoins are an important part of DeFi that plays a key role in the modular ecosystemAccording to CoinGecko there are 19. After all cryptocurrency is a digital currency where transactions are recorded on a public digital ledger called a blockchain and every process along the way is secured by cryptography.

Described by some as the holy grail of cryptocurrency stablecoins have made headlines recently as a low-volatility alternative cryptocurrency. The advantage of stablecoins is that they are built to withstand volatility in a way that other cryptocurrencies arent. Cryptocurrency traders use crypto-backed stablecoins to leverage up their position in a particular crypto as described in the MakeDAO example.

While on the subject of how stablecoins work its worth noting that the type of backing asset significantly affects the volatility of the coin in question. Unlike most cryptocurrencies stablecoins claim to be pegged to other assets including traditional fiat currencies such as the US dollar or other digital assets. These pegged digital assets make it easier for users to buy sell and trade Bitcoin and other cryptocurrencies.

Advocates hope that stablecoins can become a global fiat-free digital cash built on four main features. Price stability is built directly into the assets. Stablecoins are cryptocurrencies that are meant to be pegged to a reserve asset such as gold or the US.

Cryptocurrency works a lot like bank credit on a debit card. Stablecoins are cryptocurrencies that serve as a stable alternative eliminating the concern of the volatile nature of the crypto market. Non-collateralized stablecoins also known as algorithmic stablecoins are digital currencies that increase and reduce their coin supply automatically through the use of algorithms to ensure that.

The business case for stablecoins is that. Stablecoins are blockchain-based digital currencies just like Bitcoin or Ethereum but they are designed to maintain a consistent price over time usually by being pegged to the value of another currency or being backed by a trusted agency. They provide price stability along with the privacy and security aspects of cryptocurrency payments.

Stable assets make these coins less sensitive to fluctuations and keep their prices stable. This accelerates returns if the price goes their way. But what exactly are stablecoins.

Stablecoins are digital assets designed to mimic the exchange rate of fiat currencies such as the dollar or euro. Blockchain is a distributed ledger technology that provides a persistent and immutable record of transactions split between different nodes. Stablecoins are often pegged to fiat currency such as the US dollar and backed by collateral.

The goal of this page will be to help you understand these things and how they connect. Stablecoins offer a way to bridge the gap between fiat currencies like the US. Each digital currency exists on the blockchain while maintaining the.

Stablecoins are cryptocurrencies that are designed to maintain a stable price over time. More importantly they can rival any fiat currency-based system to transfer value globally. Because they are price-stable digital assets that behave somewhat like fiat but maintain the mobility and utility of cryptocurrency stablecoins are a novel solution to crypto volatility.

These digital coins are built on the blockchain. Some stable coins also use a computer algorithm to keep their value relatively stable. Major inconveniences that the most vocal sceptics tend to bring up are unpredictable volatility high fees and long transaction confirmations especially when the topic revolves around Bitcoin.

Stablecoins in public trade of which the top 5 have a. Stablecoins are digital currencies backed by assets such as fiat money other cryptocurrencies or gold. A blockchain-based asset is much faster cheaper and more efficient.

If not liquidation and loss can happen quickly during market downturns. Digital currencies may be backed by various asset reserves including traditional currencies precious metals algorithmic functions and other cryptocurrencies. CoinGate It is no secret that cryptocurrencies arent perfect just yet.

Put simply stablecoins are the bridge between fiat currencies like the Canadian Dollar or British Pound and cryptocurrencies. Dollar but are not issued by a central bank.

What Are Stablecoins How To Get Rich Thursday Motivation Cryptocurrency

Facebook Backed Crypto Project Diem To Launch Us Stablecoin Cryptocurrency Facebook Video Call Libra

This Just In Weekly Crypto Recap Bitcoin Flexes Its Digital Gold Muscles Cryptocurrency Bitcoin Cryptocurrency Cryptocurrency Bitcoin Price

Currency Digital Money Coins On Cash Bitcoin And Ethereum Coins On Dollar Bills And Banknotes High Resolution Stock Photo Bitcoin Mining Bitcoin Blockchain

In An Era Of Unstable Cryptocurrency Are Stablecoins The Way To Go Blockhead Technologies

Stable Coins The Next Wave Of Adoption Bitcoin Cryptocurrency Financial Documents

Stablecoins What Do They Mean For Cryptocurrency Coinhubkorea

Beyond Bitcoin Stablecoins And Cbdcs In 2021 Bitcoin Bitcoin Price Financial Institutions

Stablecoins Rather Than Cryptocurrencies Might Be The Future Of Money Fiat Money Cryptocurrency Cryptocurrency Trading

Bitcoin S Successor More Consistent Values Might Make Stablecoins A Safer Cryptocurrency Option Https Ift Tt 2ehba04 Cryptocurrency Bitcoin How To Make

Differences Between Digital Currency Cryptocurrency And Stablecoins Dignited

Stablecoins 101 What Are Crypto Stablecoins And How Do They Work

Stablecoin Vs General Cryptocurrency In 2021 Cryptocurrency Fiat Money Crypto Currencies

Youtube Video What Are The Best Stablecoins And Are They A Good Crypto Investment In 2021 Investing Youtube Videos Solving

Pin On Blockchain Criptomonedas

They Present The First Cryptocurrency Linked To The Mexican Peso In 2021 Business Card Mock Up Rings For Men Video Chatting

Stablecoin Basics Bitcoin Cryptocurrency Blockchain Technology

What Are Stablecoins 50 Blockchain Podcasts Make It Yourself

Post a Comment for "Cryptocurrencies Stablecoins Digital Currencies How Do They Work"